13 May 2012

Commerce Minister Neoclis Sylikiotis on Friday hailed the 15 bids submitted by 29 companies from around the world in Cyprus’ second licencing round for offshore hydrocarbon reserves, saying the result 'surpassed our expectation'.

Flanked by the ministers of finance and agriculture, former commerce minister Antonis Paschalides, top advisers and senior officials, Sylikiotis announced the results of the licensing round for the remaining 12 offshore blocks in Cyprus’ Exclusive Economic Zone (EEZ), half an hour after it closed. The small -for the occasion- conference room was packed to the brim with journalists, photographers, cameramen, and representatives of the bidding companies, including a large number of Europeans and Koreans sitting at the back and straining to hear the names of their competitors listed by the minister.

|

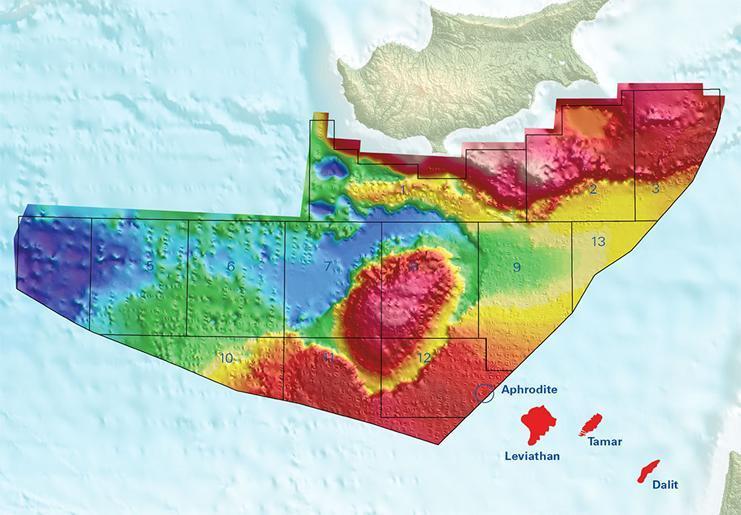

| Blocks on offer in second licensing round - except Block 12, which is licensed to Noble Energy (Source: PGS) |

According to Sylikiotis, 15 bids from five companies and ten consortia were submitted fornine of the 12 remaining blocks, the most popular being Blocks 9 and 2. Each bid was not restricted to one block, with 33 applications for licences made in total.

Block 9 neighbours the sizeable gas find in Block 12, US-based Noble Energy’s offshore concession. Noble announced last December that it had discovered an estimated 5-8 trillion cubic feet (tcf). The Cyprus Mail learnt that the only blocks not bid for were Blocks 1 (off the island’s southern coast), 4 (on the western fringes of Cyprus’ EEZ) and the smallest Block 13.

The companies involved hail from 15 countries: Canada, US, Israel, France, Russia, UK, Malaysia, Italy, Australia, Korea, Norway, Netherlands, Lebanon, Cyprus and Indonesia, with Israeli companies leading the pack in terms of the number involved. Sylikiotis noted that the results of the bidding process 'have surpassed our expectations', adding that the second bidding round was a very important moment, as it created prospects for prosperity, progress and peace for Cyprus and neighbouring countries.

He thanked all companies that expressed an interest, signifying the trust and respect they had for the Cyprus Republic and the fair procedures in place. He assured all present that the licensing process will be completed 'in full transparency' and in strict adherence to existing legislation and EU provisions. Sylikiotis highlighted that the present stage in Cyprus’ offshore hydrocarbon exploration activities was the result of the work of three consecutive governments, under presidents Glafcos Clerides, the late Tassos Papadopoulos, and incumbent Demetris Christofias. In the last decade, Cyprus has signed EEZ agreements with Egypt, Israel and Lebanon though the latter has yet to ratify it.

The second licensing round was launched last November and published in the EU Official Journal on February 11, 2012. It expired after a three-month bidding period. The bids will be evaluated by an advisory committee made up of permanent secretaries of the ministries of commerce, finance, foreign affairs and agriculture, along with the attorney-general, energy service director and geological survey department head. They will submit their recommendations to the minister who will take them to cabinet for a final decision within six months, after which negotiations with the preferred bidders will start. Licences are expected to be awarded some time in 2013, said Sylikiotis.

The list of companies and consortia involved reveals some 'big' names in the energy world, including Malaysian national company Petronas, Russian Gasprombank, French giant Total, Korean public company KOGAS, (one of the largest liquefied natural gas import companies in the world), Australian company Woodside Energy Holdings, ENI (Italy’s largest industrial company) and the US Marathon Oil.

From morning until the round’s closing time at 2pm, boxes and boxes of applications in different shapes and sizes were brought in trucks and buses hired by representatives of the 15 bidders. The boxes were stored in a 'strong room' at the ministry, kitted with an alarm system, cameras, and will remain under permanent police guard 24-hours a day for the next six months.

The significant interest shown in the second round is a far cry from that registered in the first in 2007 when only Noble was awarded a licence. There was some concern that Turkey’s sabre-rattling in the lead up to the end of the second round might put bidders off, but the results reveal that bids have been made for nearly all the blocks contested by Turkey.

With the Mediterranean basin estimated to hold trillions of cubic feet of gas, the prospect of tapping into those deposits could lead to unprecedented regional cooperation or more turbulence over maritime border disputes, particularly between Cyprus, Turkey, Greece, Lebanon and Israel. Just last month, Ankara gave the go-ahead to its state run oil firm TPAOto conduct offshore exploration in waters to the north, west and east of the island, and launched an on-shore drill in occupied Famagusta.

Turkish daily Sabah yesterday reported that Turkey’s National Security Council has decided to develop and modernise its naval bases in the Mediterranean. The paper reports that the numbers of frigates on duty in the Mediterranean will be increased from two to four, torpedo boats from three to five and coastguard ships from one to three.

Cypriots and Cypriot-based companies are involved in a number of bids submitted. Dimosthenis Mavrelis, a partner in the Chrysi Demetriadi law firm participating in bid no.9 with Israeli and Norwegian companies, hailed yesterday as a 'historic day' which will lead to economic growth and a 'new era' in Cyprus-Israel relations. 'We have worked very hard with our partners in Israel and Norway who are here and have confidence in the Cyprus Republic and its future,' he said.

Petrolina’s Dinos Lefkaritis said his company made an 'excellent choice' in choosing to collaborate with the American/Israeli joint venture Oak Delta to bid on one of the 12 blocks available.'Our partners are strong companies and we believe we’ve made a good enough bid which will at least make us contenders,' he said, noting that the newly formed companySigma was also part of the bid.

Cypriot-based companies are involved in bids from Winevia Holdings and RX-DRILL ENERGY CYPRUS, as well as the consortium PT Energi Mega Persada Tdk &Frastico Holdings Ltd. The latter bid is a concerted effort between companies from Cyprus, Indonesia and Canada. According to reports the Canadian interest in the consortium is represented by mammoth conglomerate Triple Five, which recently registered an interest in investing in ailing national airline Cyprus Airways.

THE FIVE COMPANIES AND TEN CONSORTIA BIDDING:

1. Petra Petroleum Inc (Canada)

2. Consortium: ATP East Med Number 2 BV (US), Naphtha Israel Petroleum Corp Ltd (Israel), DOR Chemicals Ltd (Israel) and Modi’in Energy Limited Partnership (Israel)

3. Total E&P Activities Petrolieres (France)

4. Consortium: Total E&P Activities Petrolieres [operator] (France) , NOVATEC Overseas Exploration & Production GMbH (Russia) and GPB Global Resources BV (Russia)

5. Consortium: Premier Oil [Operator] (UK) and VITOL (UK)

6. Consortium: Premier Oil [Operator] (UK), VITOL (UK) and Petronas (Malaysia)

7. Consortium: Edison International SpA [operator] (Italy), Delek Drilling Ltd Partnership (Israel) and Avner Oil Exploration Ltd Partnership (Israel), Enel Trade SpA (Italy) and Woodside Energy Holdings PTY Ltd (Australia)

8. Consortium: ENI (Italy) and KOGAS (Korea)

9. Consortium: CO Cyprus Opportunity Energy Public Company Ltd (Norway) and AGR Energy AS [Operator] (Israel)

10. Consortium: Oak Delta NG Exploration Joint Venture (US/Israel)

11. Consortium: Capricorn Oil (UK), Marathon Oil (US), Orange NASSAU Energie (Netherlands) and CC Energie SAL (Lebanon)

12. Winevia Holdings Ltd (Cyprus)

13. RX-DRILL ENERGY CYPRUS LTD (Cyprus)

14. Consortium: PT Energi Mega Persada Tdk & Frastico Holdings Ltd (Canada/Indonesia/Cyprus)

15. Emannuelle Geoglobal Rosario (Israel)

See related article: PGS announces seismic data availability for second licence round offshore Cyprus